Crypto Batter Com: Your Gateway to Smarter Crypto Investments Table of Contents Introduction...

How Crypto Better Sim is Changing the Game Introduction Cryptocurrency has transformed the way we...

Top Cryptos Poised to Break $1 Introduction Cryptocurrencies offer diverse investment opportunities...

Crypto Batter Explained: A Game-Changer for Blockchain Enthusiasts Table of Contents Introduction...

BTTC Crypto Price in INR Today: Updates & Predictions Introduction Cryptocurrency trading is...

Live Luna Crypto Price in INR Today Introduction The world of cryptocurrency evolves rapidly, and...

Vite Crypto Price Prediction: What to Expect in 2025 Introduction Cryptocurrency continues to...

Crypto Better vs. Crypto Batter: Breaking Down the Debate Introduction The world of cryptocurrency...

Push Crypto Price Prediction: What to Expect in 2025 Introduction Cryptocurrencies continue to...

Jio Crypto Coin Price: Latest Updates & Trends Introduction Cryptocurrency has taken the...

Crypto Batter x Airtel: Blockchain Meets Connectivity Introduction The digital world is constantly...

Pi Crypto to INR: Current Value and Future Potential Introduction The world of cryptocurrency...

Expert Bit Crypto: Unlocking the Secrets of Digital Currency Introduction Digital currency has...

How to Stay Safe in the Crypto World: Security Best Practices The world of cryptocurrency offers...

Cryptocurrency Mining in India: A Comprehensive Guide for Beginners and Enthusiasts Cryptocurrency...

The Future of Cryptocurrency in India: Trends, Regulations, and Investment Insights Introduction...

Advanced Technical Analysis: Mastering Crypto Charts Introduction: The Significance of Advanced...

01 Service How to Stay Safe in the Crypto World: Security Best Practices The world of cryptocurrency...

How Governments Are Regulating Cryptocurrency in 2025 Table of Contents Cryptocurrency, the digital...

Top 10 Crypto Trends to Watch in 2025 The crypto world is constantly evolving, bringing fresh...

Bitcoin Halving 2025: What It Means for Prices and Miners The buzz is back! Bitcoin Halving 2025 is...

How to Build Your Own Cryptocurrency: A Step-by-Step Guide Hey there, aspiring crypto creators! Have...

How to Build a Diversified Crypto Portfolio in 2025 Hey there, crypto enthusiasts! If you’re...

Ethereum 2.0: What It Means for Investors and Developers Hey there, crypto enthusiasts! If you’ve...

The Future of Bitcoin: Will It Replace Gold as a Store of Value? For years, Bitcoin has been called...

Understanding Smart Contracts: A Beginner’s Guide Imagine a world where agreements execute...

How to Buy Ethereum: A Step-by-Step Guide for Beginners Hey there, crypto curious! If you’re...

How to Analyze Crypto Projects: A Guide for Investors The cryptocurrency space is often likened to...

How to Use Crypto for Cross-Border Payments and Remittances In today’s interconnected world...

How to Earn Passive Income with Cryptocurrency in 2025 In today’s digital age, the buzz around...

Best Crypto Apps for Beginners in 2025 Hey there, crypto curious! If you’re new to the world...

How to Invest in Crypto with $100 or Less So, you’ve been hearing about crypto everywhere—from your...

The Impact of Quantum Computing on Cryptocurrency Security Hey there, crypto fans! Let’s talk...

NFTs Beyond Art: Real-World Use Cases in 2025 When you hear “NFTs,” you probably think...

How to Read Crypto Charts: A Beginner’s Guide to Technical Analysis How to Read Crypto Charts: A...

Crypto 101: 7 Essential Crypto Terms for Beginners Welcome to the World of Crypto! 🚀 Cryptocurrency...

Decentralized Finance (DeFi): The Future of Finance or Just Hype? What is Decentralized Finance...

The Rise of Altcoins: Which Ones Have the Most Potential? Introduction: The Altcoin Boom Remember...

Staking vs. Mining: Which is More Profitable in 2025? Staking vs. Mining: Which Crypto Earning...

How to Spot a Crypto Scam: Red Flags You Shouldn’t Ignore Crypto is exciting. The promise of...

Common Cryptocurrency Terms Every Newbie Should Know As cryptocurrency becomes more mainstream, more...

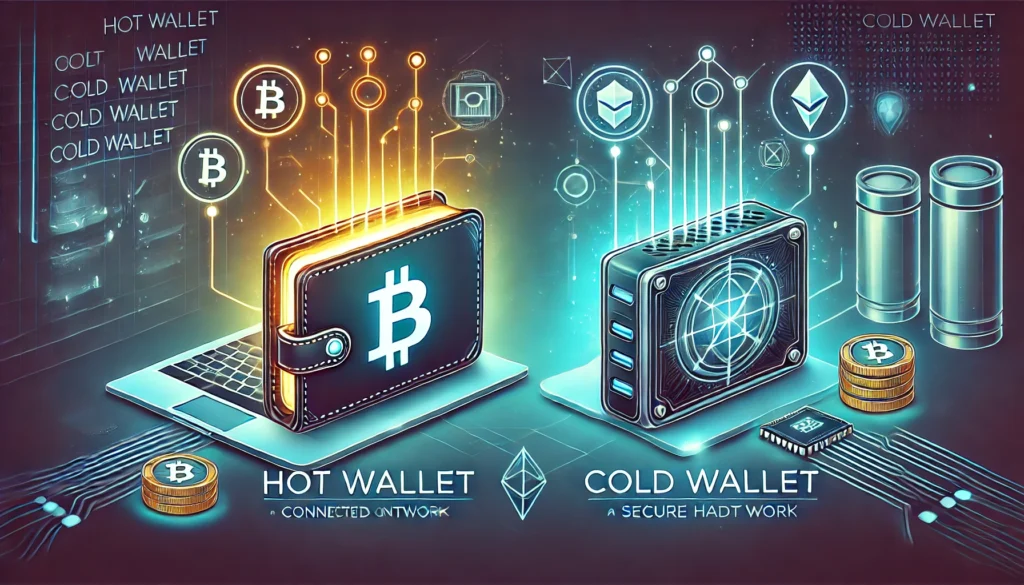

Crypto Wallets 101: Hot Wallets vs. Cold Wallets – Which is Safer? Table of Contents Crypto Hot...

How to Buy Your First Bitcoin: A Step-by-Step Guide Bitcoin Hits $99,000: Should You Buy? A...

Top 10 Cryptocurrencies for Beginners in 2025 Over the past few years, cryptocurrency has evolved...

What is Cryptocurrency? A Beginner’s Guide to Digital Money Table of Contents Introduction...